QuickBooks and FreshBooks reign supreme among software for small business accounting and are continually ranked top.

Both accounting tools have a strong track record, offer similar basic features with a few key differences, and are built for specific business purposes.

Every new business owner, accounting firm worker, or freelancer is familiar with the challenge of running a small business. Purchasing raw materials tracking payments and business expenses, or checking the inflow and outflow of money, is nothing short of a serious daily struggle that takes immense effort.

The better way is to use accounting management software that helps manage everything from invoice templates to tracking daily expenses and profits.

Besides making the entire process efficient and allowing you the time to work on other tasks, using accounting software in this day and age lifts the heavy burden off your shoulders.

While most people agree that having accounting software is a must-have for small business owners and freelancers in conjunction with other project management tools, choosing between different accounting software becomes a tedious and confusing task.

If that describes you, we’ll help you compare two leading accounting software: QuickBooks and FreshBooks, to help you determine the best option for your project.

What is Quickbooks?

QuickBooks is a popular small business accounting software that can manage an organization anywhere. The solution offers an innovative and user-friendly suite of accounting tools offering companies a clear view of their profits without needing manual imputing.

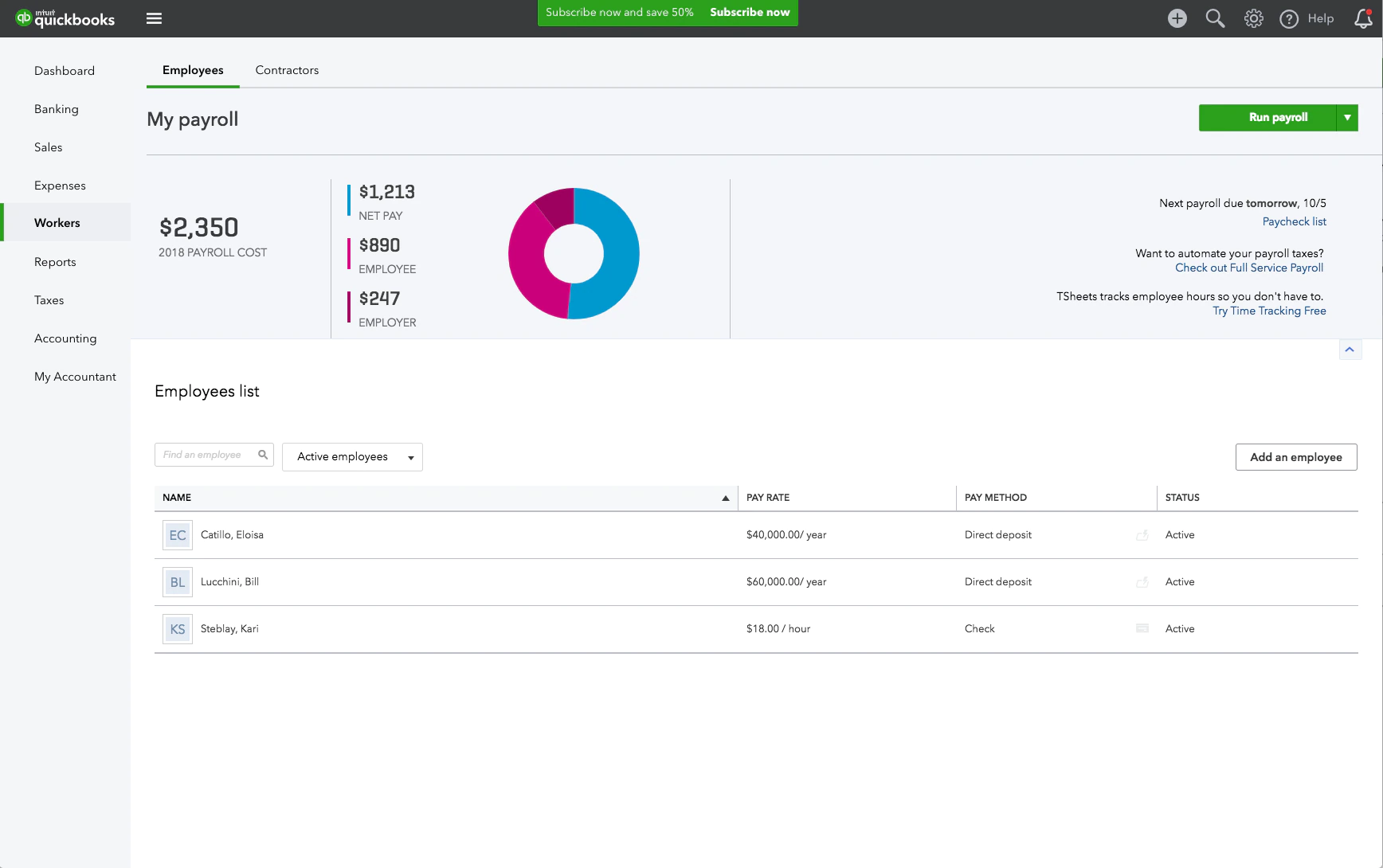

Quickbooks harmonizes with accounts, categorizes transactions spontaneously, and offers accounting teams a seamless way to manage expenses, organize books, track inventory, send invoices, and run payrolls.

Companies that use QuickBooks can easily customize its various tools like cloud accounting, time tracking, and payment processing for faster payments to suit their particular needs. The versatile software can be accessed and managed from computers, laptops, tablets, or smartphones.

Key Features of Quickbooks

#1. Collaboration

Accountants, bookkeepers, and other authorized employees of companies using QuickBooks can log in simultaneously and input data directly online and track all changes via a detailed activity log.

#2. Payroll Tax Management

QuickBooks automatically calculates taxes related to every paycheck besides paying and updating payroll taxes. The software also provides tax penalty protection and can remit up to $25,000 if the organization is penalized.

#3. Tracks Business Expenses

The QuickBooks mobile App enables taking and saving pictures of receipts which it can match to existing transactions.

QuickBooks can automatically import, track and categorize expenses when connected to a user’s bank account, credit card, or PayPal account. This feature helps users run reports showing their minute expenditures.

#4. Reports

Users can use QuickBooks to create and share professionally summarized financial and business data with partners, enabling accounting teams to customize reports to priority information and keeping accountants updated in real-time via email.

Some crucial insights users can unlock from the dashboard include insights about the business, balance sheets and financial statements, and custom-built reports and sales trends.

What is FreshBooks?

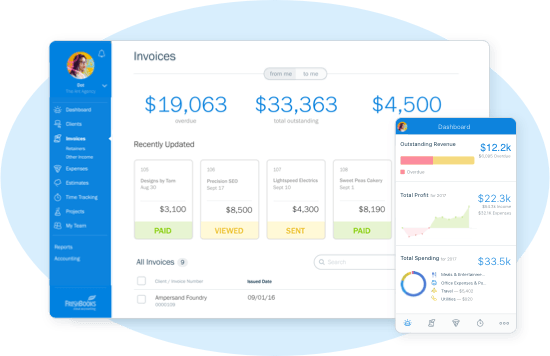

FreshBooks is a cloud-based accounting solution for freelancers and small and medium-sized businesses. The easy-to-use accounting software offers an intuitive solution for running accounting reports, organizing expenses, creating invoices, and getting paid.

Users can access FreshBooks via a web browser from any computer or choose the versatile FreshBooks App to work anywhere using iPhone, iPad, or Android devices while they’re on the move. All data is securely stored in the cloud.

FreshBooks’ users can spend less time doing paperwork since it facilitates easy invoicing and accepts online payments. You can also track hours a user has worked and turn those hours into an invoice for correct billing for work done.

FreshBooks automatically tracks all your transactions when connected to a bank account. At the same time, it also records and categorizes transactions at the same place, meaning that tax time is no longer a challenge.

Key Features of Freshbooks

#1. Accounting, Invoicing, and Payments

FreshBooks is a hassle-free, double-entry accounting tool that guarantees accuracy and compliance, helping users identify and isolate revenue items and related expenses to determine profits and losses accurately. The software’s automatic checks and balances feature allows one to guarantee debit and credit amounts.

FreshBooks users can give their accountants exclusive access to financial and reporting information so they can support their businesses better besides facilitating automatic bank reconciliation, credit management, and accounts payable.

The fast invoicing feature enables users to automate payment reminders, request partial deposits, client retainers, and automatic payment reminders.

#2. Time and Expense Tracking

FreshBooks integrates a built-in time tracker and a team timesheet that freelancers can use to log in and automatically input their time into an invoice.

Users can also log in to an expense tracker for better tracking of cash flow when they link the software with their bank accounts, besides being able to categorize expenses or mark them as billable when tracking project expenses for budgeting.

#3. Centralized Projects and Reports

Organizations using FreshBooks can easily collaborate with their business partners and contractors using the centralized file storage that provides built-in permission that secures access.

The software’s profitability tools aptly display breakdowns, summaries, and detailed reports, besides providing ready-made proposals and estimates, financial statements, client management, iOS and Android Apps, and automatic mileage trackers.

Quickbooks vs. Freshbooks

#1. Invoicing

FreshBooks’ customizable invoice designs feature a click-to-pay button to facilitate stress-free payment for online invoices, which can retrieve data directly from the timekeeping feature. Other automated functions include recurring invoices for billable hours and follow-up emails for outstanding payments. Recipients can pay their invoices instantly via Apple Pay and credit cards of ACH.

QuickBooks tracks billable hours by integrating external time-tracking apps such as TSheets and Google Calendar and includes them in the invoices. The software’s invoice builder comprises customization features such as changing colors or logo addition which users can use before sending out invoices. The payment options include a click-to-pay button that enables customers to choose between paying with Apple Pay, credit card, or ACH payment, besides sending reminders for overdue and recurring platforms.

#2. Time-Tracking

FreshBooks’ in-built time tracker is ideal for case-based and project-based businesses where workers track billable hours and related expenses. Users can view the hours on the dashboard, keep track of individual employees, and import data into the accounting system in real-time.

QuickBooks has an add-on called QuickBooks Time at an extra cost for users interested in tracking time worked by full-time or part-time employees. Companies that don’t pay for the add-on must input payroll as an expense and categorize the service offered. That sounds cumbersome way to track an employee or freelancer’s time.

#3. Expense Tracking

QuickBooks offers debit and credit card support, keeping users regularly informed on profit margins within the monthly accounting cycle. The only downside here is that it requires some manual entry since QuickBooks Online shows only line items and not more nuanced breakdowns. Users can update monthly repayments using the QuickBooks mobile App to take pictures and upload receipts.

FreshBooks is designed explicitly for invoicing and payment collection, meaning users must integrate an external accounting system. Nonetheless, the software provides exceptional expense tracking features such as project time tracking, receipt tracking, and sales tax management, which come in handy for beginners in the business.

#4. Ease of use

QuickBooks and FreshBooks present easy-to-use graph-filled intuitive dashboards with vertical sidebars through which users can access different features, including those with little or no accounting knowledge. However, QuickBooks appears easier to set up compared to FreshBooks. Users can easily record and modify journal entries in FreshBooks, as well as begin balances and manage chart accounts.

FreshBooks facilitates easier data entry; however, users can’t close a prior period transaction which is necessary to prevent unsolicited changes to accounting data. While it’s possible to enter beginning balances and modify journal entries on FreshBooks, you need to be an account user registered using a different email address to accomplish that.

#5. Tax Calculations

Intuit, the creator of the famous TurboTax and QuickBooks online, has included plenty of supportive tax features in the software. The tool is designed to generate as many end-of-year tax forms as the number of employees a user has. Additionally, business owners can organize expense and income taxes by category to compute the amount they owe quarterly taxes besides tracking sales tax and automatically adding payable taxes on invoices.

FreshBooks offers a tax planning feature, but it’s less versatile than the one provided by its main competitor, which can make tax planning a bit challenging for freelancers and non-accountants. FreshBooks also offers some tax assistance, but it cannot track expenses via receipt scanning; instead, users can only track taxes by linking their bank accounts. While that should be fine, a busy office’s lack of an in-built receipt scanner can be frustrating.

#6. Accounting

FreshBooks boasts of a double-entry accounting feature that helps to track revenue items against expenses. As a result, users have a rough idea of their profits and losses well in advance. The feature also ensures that debit and credit amounts are at par and instantly pinpoints errors to avoid tax season challenges.

FreshBooks users can import and categorize financial transactions using different categories for transfers, equity, or refunds, besides summarizing reports that can be exported to Excel. Users can also easily add their accountant to the FreshBooks account so they can have exclusive access.

QuickBooks is designed to track all expenses by sorting transactions and separating them into tax categories. The software also links photos of receipts to their respective transactions and uses raw data to generate different types of reports. The QuickBooks mobile app uses smartphone GPS systems to automatically track the distance a user travels in miles and creates a report that accurately logs business trip deductions.

#7. Reporting and Dashboards

Both accounting software provides different kinds of reports, with FreshBooks producing specific reports on profit and loss, client accounts, sales tax summaries, expenses, and payments collected. The tool’s dashboard also contains the most applicable charts and graphs covering monthly recurring revenue, outstanding revenue, revenue streams, total profit, spending, and any unbilled time.

The QuickBooks dashboard, on the other hand, has a Reports Center on its navigation menu that gives users a quick way to locate the standard pre-set report templates and the ability to customize their own. A “management reports” section enables users to build professional reports with cover pages, preliminary pages, tables of contents, and endnotes.

Examples of reports included in the pre-set templates include balance sheets, sales tax reports, audit logs, cash flow statements, open invoices, profit and loss, budget overviews, and customer reports compiled by class, customer, month, and year-to-date.

#8. Pricing

Both QuickBooks and FreshBooks offer subscription-based plans, but when it comes to scalability, the former provides a better price schedule than the latter. With QuickBooks, you can link your accountant and become a member of a 5+ million online community.

As for FreshBooks, it doesn’t offer bank reconciliation for users who select the Lite plan, and the number of users still needs to be higher. Most importantly, take note that scaling is becoming increasingly expensive.

QuickBooks Pricing

- Simple Start: 1 user, $25 per month, 2 accounting firms

- Essentials: 3 users, $50 per month, 2 accounting firms

- Plus: 5 users, $80 per month, 2 accounting firms

- Advanced: 25 users, $180 per month, 3 accounting firms

FreshBooks Pricing

- Lite: $180 annually or $15 monthly

- Plus: $300 annually or $25 monthly

- Premium: $600 annually or $50 monthly

- Select: Custom pricing

All the FreshBooks plans except Select include a single user; users pay $10 for any additional team member.

#9. Integration Support/Integrations

There are at least 400 native integrations included in QuickBooks. They include business banking, payment software, e-commerce, CRM, and several other categories that deliver control and visibility over users’ financial data and sales processes. Other add-ins include PayPal and ReceiptBank, which keep transactions up to date.

FreshBooks integrates over 100 integrations targeting small business owners and freelancers; they facilitate connecting the app to tax filing tools and human resources to the payroll-tax-invoicing circle. Integrations like Squarespace or Zapier help users track payments besides processing and organizing tens of other systems.

#10. Payroll

QuickBooks offers a full-service payroll plan with unlimited payroll runs and end-of-year forms. Other features include auto-calculated taxes, an online portal that lets employees view their tax data and pay stubs, and support for garnishments and deductions besides downloadable historical data reports. Users can also access a premium plan that supports a same-day direct deposit and employee’s company administration and Human Resource support center.

FreshBooks supports external integrated employee payrolls since it doesn’t have its native payroll feature. The software supports Gusto, charging between $6 and $12 per user per month and an introductory $39 monthly fee. It also supports the Canadian-based PaymentEvolution payroll service at a limited free tier or a $22 per month tier.

#11. Customer Support

QuickBooks runs online customer support, meaning you must be logged in to get access. There’s also an in-built knowledge base where users can ask questions and research topics, besides a robust community forum where they can find answers.

FreshBooks’ customer service operates a live chat option alongside telephone customer support for 12 hours, five days a week. The company’s website runs a searchable help center that addresses the most common customer service topics.

Quickbooks vs. Freshbooks: Differences Summary

Features

QuickBooks

FreshBooks

Overview

Founded in 1983

Founded in 2003

Target Markets

Best for companies that sell products

Best for service-based businesses, freelancers, and solopreneurs

Key Features

Creates customized invoices with individualized logos and fields before generating them on the go with the mobile app

Easy-to-use double-entry accounting tools guarantee accuracy and compliance and make it simple to prepare financial reports

Pricing

Simple Start: $25/month Essentials: $50/month Plus: $80/month Advanced: $180/month

Lite: $15/month or $180 annually Plus: $25 monthly or $300 annually Premium: $50 monthly or $600 annually

Support

Telephone, email, or messaging featured articles in-product help product training options searchable knowledge base user community.

Telephone and email support in-product help In-product messaging FAQs searchable knowledge base.

Ease of Use

Easy setup process that lets users dive straight in. Offers basics and details added as you proceed.

A well-presented welcome page that displays setup progress, with a vertical menu bar to the left of the screen.

Author’s Note

When to Choose Quickbooks

QuickBooks is ideal for business people selling products and managing inventory as its inventory management feature enables tracking daily sales of goods from different channels, including Shopify and PayPal. Its comprehensive functionality that integrates other Intuit products as QuickBooks point-of-sale grows allows it to grow along with a user’s business.

As the more popular solution, QuickBooks is also popular with accountants and business owners who want to align with their accountants, as it efficiently manages integrations, bank feeds, and tax compliance. Choose QuickBooks if you need affordable accounting software that’s designed to scale along with your business.

When to Choose Freshbooks

FreshBooks is popular with solopreneurs, freelancers, and small business owners looking for top-of-the-range accounting software without focusing on accountants.

It has time tracking and billing functionalities, project management, invoicing, and third-party integrations to popular payment tools like Stripe, which are ideal for small businesses or newbies.

FreshBooks’ hassle-free functionality is designed for general audiences and is, therefore, easy to set up and administer. It also enables fast and easy integrations with small popular business tools.

Next, you can check out payroll software for startups to medium businesses.