The post How to Start Trading Forex in Benin by Sarah Horvath appeared first on Benzinga. Visit Benzinga to get more great content like this.

Trade forex in Benin with Interactive Brokers or FOREX.com as your trusted online forex brokers.

As a developing nation, forex trading is still largely unheard of in most parts of Benin. However, as internet access becomes more widely available throughout the country, the forex market is becoming more easily accessible to the average trader. Before you trade forex in Benin, be sure to read our complete guide to brokers, trading strategies, best practices and more. Foreign exchange trading is booming, but how can the financial markets in Benin give you the access you need?

Earn cash back on your FX trades

Open an account in as little as 5 minutes. Spot opportunities, trade and manage your positions from a full suite of mobile and tablet apps.

Table of contents

[Show]

Get Started with Forex in Benin

Getting started with a retail forex career begins by opening a brokerage account. Follow these simple steps to open your account, add your trading funds and place your trade.

Step 1: Connect to the Internet

Before you can begin comparing brokers, be sure that you have a stable and private connection to the internet. Do not trade or open a brokerage account on a public computer, like a library computer or in an internet café.

Step 2: Choose a Forex Broker

As a trader in Benin, you’ll have access to international brokers offering services in your territory. Local brokers are regulated by the Central Bank of West African States, while international brokers are licensed in their own jurisdictions. Compare a few brokerage options in terms of fees, available currencies and supported trading tools before you open an account.

Step 3: Download a Trading Platform

Though your broker might offer you access to its own in-house trading platform, some brokers require that you download a 3rd-party trading platform like MetaTrader 4 or 5. Check and see which platforms your broker supports before you download it.

Step 4: Fund Your Account

After your account has been opened in full, link a bank account, debit card or electronic wallet to add your trading funds. It might take a few days for your trading funds to appear in your account.

Step 5: Place Your First Trade

Once your trading funds clear into your account, you can officially place your 1st currency trade through your broker. Remember, foreign exchange transactions occur instantly unless you use a special order type that helps you hedge against risk.

Benin Forex Trading Strategies

There are many trading strategies that you can use in Benin to make a profit when trading forex. Because the West African CFA franc is considered to be a more volatile currency in its currency pairs than reserve currencies like the dollar, pound or euro. Most forex traders use a strategy that relies heavily on technical analysis. Technical analysis is a type of market analysis that uses past charting patterns and formations to predict how a currency will move in the future.

Let’s take a look at a few of the most common chart patterns you can use when trading the West African CFA franc as your base currency. Though these chart patterns don’t guarantee that you’ll see a profit when you trade, they can be very useful in helping you form your trading strategy.

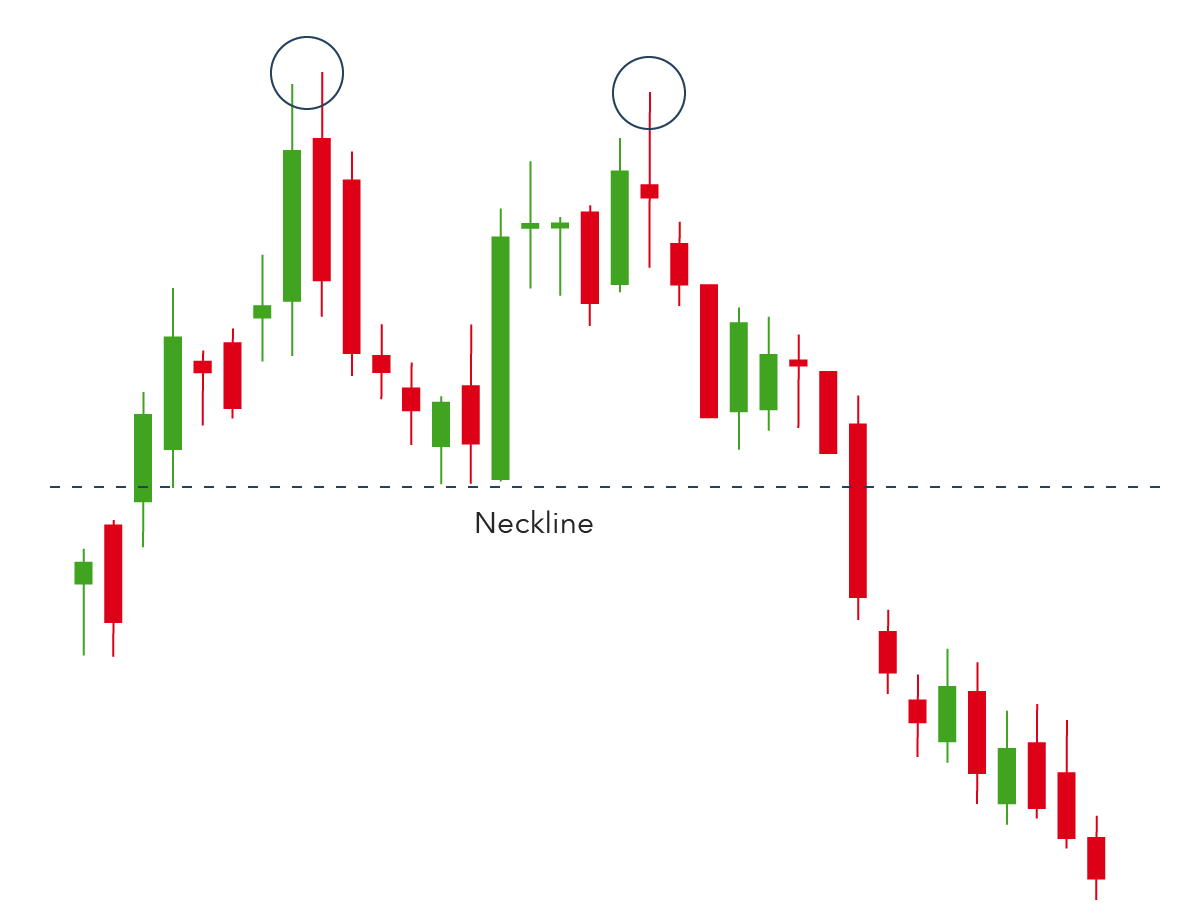

Double Top

The double top pattern is a bearish pattern that indicates that a currency will soon begin a downward movement. In most cases, the currency’s value will establish a support level, reach a peak, dip down to the support level and then reach another peak at roughly the same time. When the currency breaks through the support level after the 2nd peak, a sell signal is triggered and the currency will likely continue its decline.

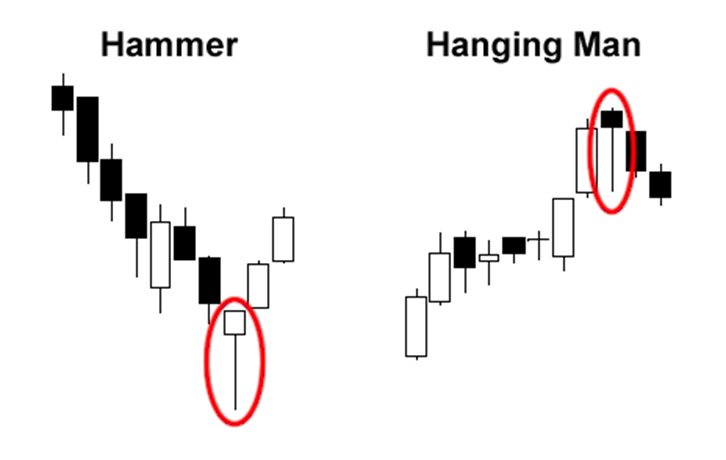

Reversal Candlesticks

If you’re looking to use a very short-term strategy, consider searching for reversal candlesticks. A reversal candlestick is a formation that indicates that a currency will very soon change its value and move in the opposite direction. A reversal candlestick might be bullish or bearish depending on where it is placed and its strength. As a general rule, you can tell how strong a candlestick is by measuring its shadow length — a longer shadow means that the reversal trend is more likely to be confirmed.

Forex Trading Example in Benin

Forex traders generally earn money by taking a long position against their base currency that appreciates in value against the counter currency or by being short when the base currency falls in value. Capitalizing on movements in currency exchange rates allows traders to earn more of their counter currency by taking profits. Let’s look at an example.

Natasha is a trader in Benin who holds the West African CFA franc (XOF) as her base currency. After doing her research, she believes that the franc will soon fall in value against the Japanese yen (JPY). Natasha deposits 1,000,000 CFA into her account. Her broker offers her 10:1 leverage on this trade, which means that she can place orders worth up to 10,000,000 CFA.

In this example, 1 XOF is currently equal to 0.19 JPY. Natasha shorts her entire amount of francs into yen, leaving her with ¥1,900,000 in her brokerage account. Natasha keeps her eyes on the value of both the CFA franc and the yen. When 1 XOF is equal to only 0.17 JPY, she decides to take her profits by converting her lot of yen back to CFA francs. This leaves Natasha with about 11,176,470 CFA in her margin. After returning the money she borrowed in leverage, Natasha has made a profit of about 1,176,470 CFA on this trade.

Making Money with Forex in Benin

Earning money with forex trading is completely legal in Benin and there are no limitations to the amount of profit that you can make from your trading. You can also freely convert West African CFA francs into any other currency, and you can deposit as much money as you like into an international brokerage account.

While forex trading is becoming more popular throughout Africa, lawmakers have had difficulty keeping up with this changing market. This means that there are still many illegitimate forex brokers and forex scams operating throughout Benin and West Africa as a whole. Be sure to thoroughly research every broker you consider working with and check up on their licensing status with the Central Bank of West African States or another international body before you open an account.

Best Online Forex Brokers in Benin

There are very few laws that regulate forex brokers operating in Benin when compared with other countries like the U.S. Working with only licensed, legitimate brokers is one of the best ways to protect your capital and avoid forex scams. Not sure where to begin? Consider a few of our favorite forex brokers offering services to investors in Benin.

get started

securely through eToro’s

website

Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. U.S. traders can begin buying and selling both major cryptocurrencies (like Bitcoin and Ethereum) as well as smaller names (like Tron Coin and Stellar Lumens).

eToro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though eToro isn’t a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best For

- International Forex/CFD Traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

- Simple platform that is easy to master

- CopyTrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- U.S. traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

get started

securely through FOREX.com’s

website

FOREX.com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.com’s extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.com is impressive, remember that it isn’t a standard broker.

Best For

- Beginner forex traders

- Active forex traders

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

- Cannot buy and sell other securities (like stocks and bonds)

Get started

securely through AvaTrade’s

website

A fully regulated broker with a presence in Europe, South Africa, the Middle East, British Virgin Islands, Australia and Japan, Avatrade deals with mainly forex and CFDs on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in Dublin, Ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best For

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

- Does not accept customers from the U.S. as it isn’t regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

Get started

securely through Interactive Broker Primary’s

website

Interactive Brokers is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. You can buy assets from all around the world from the comfort of your home or office with access to over 150 global markets, allowing you to access the forex market with ease. Options, futures and fund trading are also available, and most traders won’t pay a commission on any purchase or sale.

IBKR is geared primarily toward experienced traders and investors but now with the availability of free trades with IBKR Lite, casual traders can also acclimate to IBKR’s offerings.

Best For

- Access to foreign markets

- Detailed mobile app that makes trading simpler

- Massive range of accounts and assets

- Quality desktop platform

- Mobile app mirrors the desktop platform

- Low margin rates

- The scope of this platform may intimidate some traders

get started

securely through IG Markets’s

website

IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The broker only offers forex trading to its U.S.-based customers, the brokerage does it spectacularly well. Novice traders will love IG’s intuitive mobile and desktop platforms, while advanced traders will revel in the platform’s selection of indicators and charting tools. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface.

Best For

- New forex traders who are still learning the ropes

- Traders who prefer a simple, clean interface

- Forex traders who trade primarily on a tablet

- Easy-to-navigate platform is easy for beginners to master

- Mobile and tablet platforms offer full functionality of the desktop version

- Margin rates are easy to understand and affordable

- Access to over 80 currency pairs

- U.S. traders can currently only trade forex

- Customer service options are lacking

- No 2-factor authentication on mobile

Forex Terminology

One of the first things you’ll notice when you trade forex is that forex brokers and traders have their own unique “language” they use to discuss their trades. Familiarizing yourself with a few of the most common forex terms you’ll encounter will make it easier to learn about the market before risking any of your own money. Here are a few terms you’ll need to know before you get started with forex trading.

- Pip: A pip is the smallest incremental change in a currency pair’s exchange rate, usually rounded to the 4th decimal place. Forex traders often calculate currency movements using pips. For example, if the value of the USD moves from 1.0000 to 1.0010 in relation to another currency, you might hear a trader say that the value has moved by 10 pips.

- Lot size: A lot size is a standardized trading amount, usually 100,000 base currency units.

- Orders: When you want to initiate a trade, you’ll do so by placing an order through your forex broker. Your order tells your broker which currencies you’d like to exchange when the trade should be placed and the exchange the order should be executed at. There are multiple types of orders, and the orders that you can use will vary depending on the options that your broker supports.

- Calls: If you use leverage to trade and the value of your portfolio decreases, your broker might subject you to a margin call. If you receive a margin call, you must close out your position or deposit more money into your account to make up the difference. Margin calls are more common when higher leverage levels are used in poorly funded accounts, so be very wary of the amount of leverage you use.

Entering the Emerging Forex Market

Though forex trading in Benin isn’t as widespread as other countries in Africa, it’s becoming easier to access the market. Unfortunately, regulations from the Central Bank of West African States haven’t quite caught up to international regulations from bodies like the Financial Industry Regulatory Authority or the Cyprus Securities and Exchange Commission.

Frequently Asked Questions

Which country trades forex the most in Africa?

The most active country in Africa for Forex trading is Nigeria. According to the Bank for International Settlements, Nigeria had the highest average daily volume traded in 2017 at $11.9 billion. This was followed by South Africa and Egypt at $9.7 billion and $6.3 billion respectively. The total African Forex market turnover in 2017 was estimated to be around $43 billion, making Africa one of the largest regional foreign exchange markets.

Answer Link

Which African countries trade forex?

In Africa, a number of countries have become increasingly involved in forex trading, with countries such as Nigeria, South Africa, Kenya, Ghana, Botswana and Benin now boasting well-established trading communities.

Answer Link

Do you need a license to trade forex in Nigeria?

No, you do not need a license to trade forex in Nigeria. However, it is strongly recommended that you become educated and familiar with the basic concepts of forex trading before investing any money. There are numerous online resources available for this purpose.

Answer Link

The post How to Start Trading Forex in Benin by Sarah Horvath appeared first on Benzinga. Visit Benzinga to get more great content like this.