The post Best Mid-Cap ETFs Right Now by Chetan Shekar appeared first on Benzinga. Visit Benzinga to get more great content like this.

Mid-cap companies are valued at anywhere between $2 billion to $10 billion. Enterprises that fall into this category are businesses with initial success working to keep the momentum going. The mid-cap sector offers a sweet spot between small-cap stocks and large-cap stocks. If you’re looking to expand your investment portfolio, you may find an easier footing in mid-cap ETFs.

These ETFs provide you with a bundle of companies to invest in without breaking the bank. If you have doubts about investing in a particular company, ETFs can give you a better chance of returns with reduced risk.

Quick Look: The Best Mid-Cap ETFs

- Vanguard Mid-Cap Index Fund ETF

- iShares Core S&P Mid-Cap ETF

- iShares Russell Mid-Cap ETF

Contents

- Quick Look: The Best Mid-Cap ETFs

- Biggest Gainers and Losers

- Premarket Mid-Cap ETFs

- Aftermarket Mid-Cap ETFs

- Why Invest in Mid-Caps?

- 1. Mid-Cap ETFs Are Less Likely to Fail

- 2. Mid-Cap ETFs Are Geared for Growth

- 3. Mid-Cap ETFs Are Liquid

- Top 3 Mid-Cap ETFs by AUM

- 1. Vanguard Mid-Cap Index Fund ETF (NYSEARCA: VO)

- 2. iShares Core S&P Mid-Cap ETF (NYSEARCA: IJH)

- 3. iShares Russell Mid-Cap ETF (NYSEARCA: IWR)

- Best Online Brokers for Mid-Cap ETFs

- 1. TradeStation

- 2. Firstrade

- 3. TD Ameritrade

- Ready for Growth

- Frequently Asked Questions

Biggest Gainers and Losers

Here’s a quick look at the ETFs on the market with the best profits and worst losses.

Premarket Mid-Cap ETFs

Here’s a quick look at the premarket positions of these ETFs to help you predict price movements during trading sessions.

Aftermarket Mid-Cap ETFs

Here’s a quick look at the positions of ETFs after major stock exchanges are closed for trading.

Why Invest in Mid-Caps?

Take a look at our top 3 reasons you should consider investing in mid-cap ETFs.

1. Mid-Cap ETFs Are Less Likely to Fail

These ETFs track companies with business models that are less volatile than small-cap start-ups and more profitable than large-cap corporations. Companies included in these ETFs generally have an established reputation in the market and a substantial client base.

Many mid-cap ETFs let you invest in underlying companies that show promising signs of value, growth and stability. For example, the Deep Value ETF (NASDAQ: DVP) mirrors the TWM Deep Value Index and holds assets in reputed enterprises such as Macy’s Inc. (NASDAQ: M), HP Inc. (NASDAQ: HPQ) and International Paper Co (NASDAQ: IP) that have been industry-leading brands for decades.

2. Mid-Cap ETFs Are Geared for Growth

Companies included in mid-cap ETFs rely heavily on cash-flow positive balance sheets to secure their funding. Their extensive experience in the industry allows them to avoid business blunders that may stunt their growth. Large-cap companies with slow earnings often rely on dividends to lure investors, while small-cap companies can have a tough time convincing venture capitalists and independent financiers to back new ideas.

3. Mid-Cap ETFs Are Liquid

Many mid-cap ETFs have an average of 100,000 shares traded every day. These ETFs with underlying mid-cap companies can be bought at a relatively low cost, usually at an expense ratio of less than 0.5%.

Low-cost mid-cap ETFs with high liquidity:

Ticker Symbol

ETF

Daily Trade Volume

Expense Ratio

VO

Vanguard Mid-Cap Index ETF

1,238,800

0.04%

IWR

iShares Russell Midcap ETF

3,344,100

0.19%

IWP

iShares Russell Midcap Growth ETF

504,600

0.24%

IWS

iShares Russell Midcap Value ETF

177,4300

0.24%

VOE

Vanguard Mid-Cap Value ETF

1,093,100

0.07%

VOT

Vanguard Mid-Cap Growth ETF

238,700

0.07%

SCHM

Schwab U.S. Mid-Cap ETF

709,300

0.04%

It’s best to take a look at the financial health of mid-cap ETFs over the last 10 years before you invest. You can freely access the financial information of mid-size firms for actionable insights to influence your trading.

Top 3 Mid-Cap ETFs by AUM

Some traders might overlook mid-cap ETFs for stocks in small-cap or large-cap companies, but mid-cap ETFs can open the doors to untapped potential in the stock exchange market.

Before you begin trading ETFs, compare expense ratios, historical performance, liquidity and total assets under management (AUM). Take a look at our list of top mid-cap ETFs by AUM.

1. Vanguard Mid-Cap Index Fund ETF (NYSEARCA: VO)

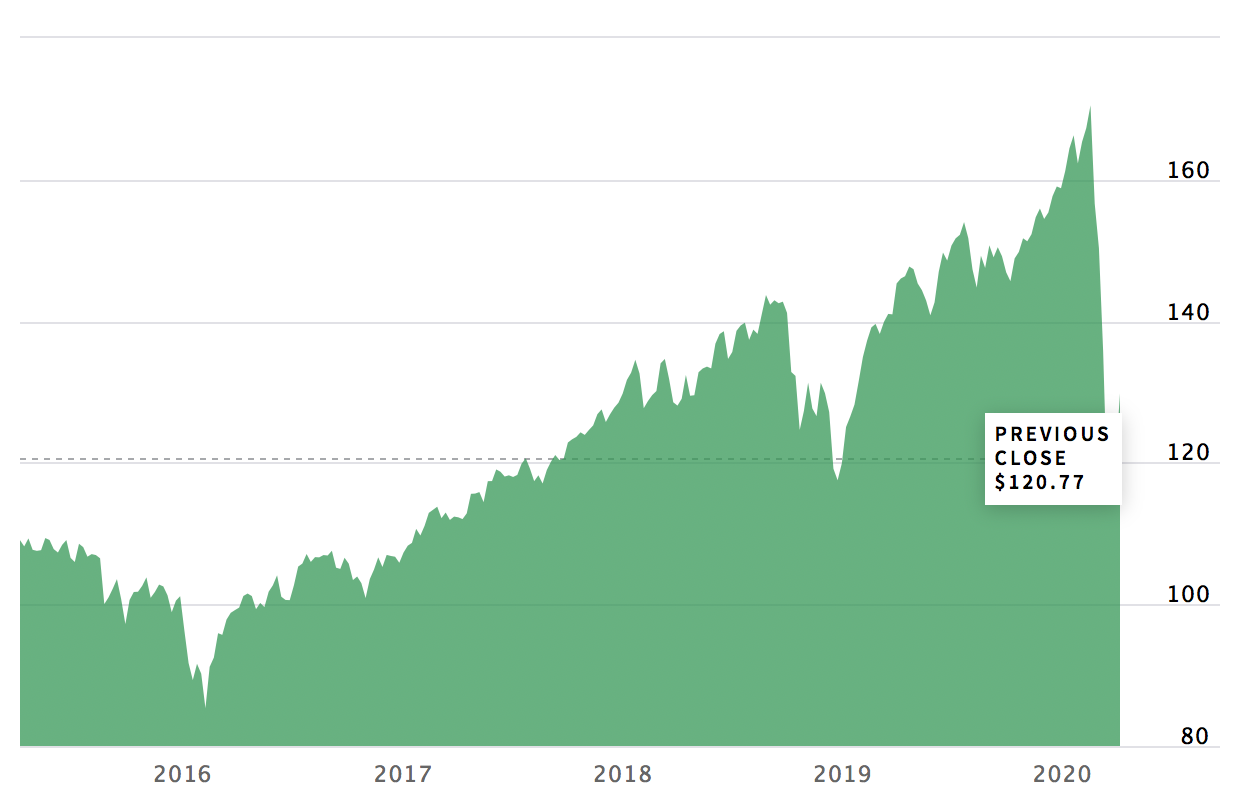

The Vanguard Mid-Cap Index Fund ETF has been on the market since 2004, hoping to track the CRSP U.S. Mid-Cap Index. At press time, the fund was fully vested, and it has low fees for buyers.

With $151.3 billion in total assets, 366 holdings and strong returns, you can easily trust Vanguard to grow the fund and help it track as it should.

Vanguard Mid-Cap ETF (ARCA:VO)

204.520

-0.01

[0%]

Sell

Trade Now

–

183.07 – 228.27

0.00K

0.00K/59.51K

0.00K

0.00K

/0%

0.000

0.00K

(:)

0.000

[%]

Sell

Trade Now

–

–

0.00K

0.00K/0.00K

0.00K

0.00K

/0%

0.000

0.00K

2. iShares Core S&P Mid-Cap ETF (NYSEARCA: IJH)

The iShares Core S&P is a low-cost, tax-efficient ETF designed for long-term growth. With net assets of $63 billion, IJH has seen solid growth since 2000, tracking the S&P Mid-Cap 400 Index. The fund is quite transparent, giving investors an idea of everything in which it invests, allowing individuals to avoid offending their sensibilities.

You can buy in at any time with a 0.05% management fee, ensuring that you can grow your net worth over several years or even decades.

iShares Core S&P Mid-Cap ETF (ARCA:IJH)

242.040

-0.01

[0%]

Sell

Trade Now

–

217.45 – 272.95

0.00K

0.00K/1.12M

0.00K

0.00K

/0%

0.000

0.00K

3. iShares Russell Mid-Cap ETF (NYSEARCA: IWR)

Opened for trading in 2001 and carrying over $30 billion in assets, the iShares Russell Mid-Cap ETF tracks the Russell Mid-Cap Index. A low 0.19% management fee allows you to remain a part of the fund, you can review the fund’s holdings at any time.

This ETF focuses on domestic companies that offer long-term growth for the investor. You might turn to this ETF to buy into the market at a lower price, but you will most likely see growth over the years and decades ahead.

iShares Russell Mid-Cap ETF (ARCA:IWR)

67.840

0

[0%]

Sell

Trade Now

–

60.73 – 75.44

0.00K

0.00K/1.28M

0.00K

0.00K

/0%

0.000

0.00K

Best Online Brokers for Mid-Cap ETFs

You can invest in the best ETFs with an online broker. ETFs can be traded commission-free through most platforms. Benzinga recommends the following online brokers for you to get started.

1. TradeStation

get started

securely through TradeStation’s

website

TradeStation is for advanced traders who need a comprehensive platform. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. TradeStation’s app is also equally effective, offering full platform capabilities.

Best For

- Advanced traders

- Options and futures traders

- Active stock traders

- Comprehensive trading platform and professional-grade tools

- Wide range of tradable securities

- Fully-operational mobile app

- Confusing pricing structure to leave new traders with a weak understanding of what they pay

- Cluttered layout to make navigating TradeStation’s platform more difficult than it should be

TradeStation is a cutting-edge online broker that empowers your every trade with reliability and mobility. You can open a TS SELECT account with a $2,000 minimum deposit or a TS GO account with a $0 minimum deposit.

ETFs can be traded commission-free on TradeStation. You can access more than 2,000 ETFs with the ability to track indices, sectors, commodities and currencies on the platform. Its infrastructure allows you to glance over the historical database of ETFs, stocks, futures and index data as far back as 50 years. TradeStation is regulated by the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

2. Firstrade

Get started

securely through Firstrade’s

website

Easy to use and quick to master, Firstrade offers new and veteran traders a simple way to start investing with rock-bottom pricing. Firstrade’s platform is simple and streamlined and it extends this convenience to its mobile app. The broker has recently added a wealth of new app features that make options and stock trading faster as well.

The company’s $0 commissions on stocks, ETFs, mutual funds and even options make Firstrade especially appealing for frequent traders. Firstrade also offers margin trading with new lowered rates. Firstrade also currently doesn’t offer access to futures or forex trading, and some more advanced traders may dislike the broker’s simple platform.

Best For

- New traders looking for a simple platform layout

- Native Chinese speakers seeking research and education tools in Chinese

- Mobile traders who needs a secure and well-designed app

- Simple platform easy enough for even complete novices

- Quick Bar tool for easy trading throughout the day

- Free access to Morningstar trading reports and other news in both English and Chinese

- Secure mobile app with enhanced security and trading features

- Simple brokerage platform doesn’t include as many charting tools as competitors

- No access to futures or forex markets

Firstrade is an industry-leading online broker with a full line of investment products and tools to help you plan your financial future. It has a recorded trade execution speed of 0.1 seconds. You can open an account on Firstrade with a $0 minimum deposit.

Firstrade allows you to trade ETFs at a $0 commission rate. You can find and filter through 2,000 ETFs with more than 30 different screening criteria on the platform. Firstrade is regulated by the SEC and FINRA.

3. TD Ameritrade

get started

securely through TD Ameritrade’s

website

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Best For

- Novice investors

- Retirement savers

- Day traders

- World-class trading platforms

- Detailed research reports and Education Center

- Assets ranging from stocks and ETFs to derivatives like futures and options

- Thinkorswim can be overwhelming to inexperienced traders

- Derivatives trading more costly than some competitors

- Expensive margin rates

TD Ameritrade, an innovative, intuitive online broker, offers a giant presence for investors. You can open an account on the platform with a $0 minimum deposit.

You can trade ETFs commission-free on TD Ameritrade. It gives you access to over 2,300 ETFs with free level 2 data. Its dedicated ETF market center helps you research and monitor ETFs with predefined screens based on lifecycle, commodities, bear markets or your custom settings. TD Ameritrade is regulated by FINRA.

Ready for Growth

Mid-cap companies are constantly going through market revaluation. Everything from the size of the company to its yearly earnings can drastically affect the price of mid-cap stocks.

Diversifying your financial portfolio with a mid-cap ETF instead of investing in a single mid-cap company can balance your risk profile (as opposed to trading penny stocks, for example) and gives your investments ample time to grow.

Frequently Asked Questions

What are mid-cap companies?

Mid-cap companies are companies that are valued between $2 and $10 billion.

Answer Link

Why invest in ETFs?

ETFs are bundles of stocks and are a great way to dirversify your portfolio.

Answer Link

Which mid-cap ETFs should I invest in?

Benzinga offers a list of recommeded mid-cap ETFS on the list above.

Answer Link

The post Best Mid-Cap ETFs Right Now by Chetan Shekar appeared first on Benzinga. Visit Benzinga to get more great content like this.