The post Arbitrum Airdrop Guide by James Wells appeared first on Benzinga. Visit Benzinga to get more great content like this.

Arbitrum is an Ethereum scaling solution that is taking the crypto community by storm with hints of a potential upcoming Arbitrum token airdrop. With its unique set of off-chain and on-chain executions, Arbitrum strives to provide lightning-fast and cost-effective transactions.

In recent months, Arbitrum has picked up considerable momentum, with increased liquidity flowing to the network. Rumors are circulating about a potential Arbitrum crypto airdrop in the near future.

Optimism, an Ethereum scaling solution about half the size of Arbitrum, conducted the first stage of its airdrop in mid-2022, airdropping an average airdrop of 777 Optimism tokens per wallet (roughly $500 at the time). Given Arbitrum’s superior size to Optimism, there is no telling how lucrative an Arbitrum airdrop could be. For example, owners of Bored Ape Yacht Club non-fungible tokens (NFTs) were airdropped tens of thousands of dollars worth of $APE.

Although there have been no official announcements yet, several key reasons could explain why an Arbitrum airdrop is more than likely. The following article will explore the Arbitrum ecosystem and the likelihood of an airdrop — discussing strategies that could increase your chances of eligibility.

Table of contents

[Show]

What is Arbitrum?

Arbitrum is a Layer 2 solution that seeks to address the network congestion, poor efficiency and higher transaction fees on Ethereum — the second largest cryptocurrency by market capitalization in the world.

Arbitrum improves the capabilities of Ethereum smart contracts through a method called optimistic rollup, a type of data compression technique for blockchain transactions that roll up batches of transactions into a single transaction.

The benefit of this technique is that blockchains only need to verify one transaction — the rolled-up transaction — instead of having to confirm each individual transaction that is part of the rollup. This process improves efficiency, as the blockchain only needs to confirm one transaction, avoiding the need to wait while numerous transactions are validated at once.

Although this process takes place on a separate layer to boost speed and scalability, Arbitrum leverages the security provided by the Ethereum mainnet. All validated transactions on Arbitrum are moved back to Ethereum.

Arbitrum vs. Other Blockchain Networks

Arbitrum is designed to provide a user-friendly platform that developers can work in to launch highly scalable and efficient Ethereum-compatible decentralized applications (dApps). However, it’s not the first platform seeking to overcome Ethereum’s limitations.

Notable competitors include Polygon, Optimism and Metis, among others. The following features separate Arbitrum from the rest.

High EVM Compatibility

Arbitrum is widely regarded as one of the most EVM-compatible rollups. It’s compatible with the EVM at the bytecode level and any language that can compile to EVM such as Solidity and Vyper.

Market Leader

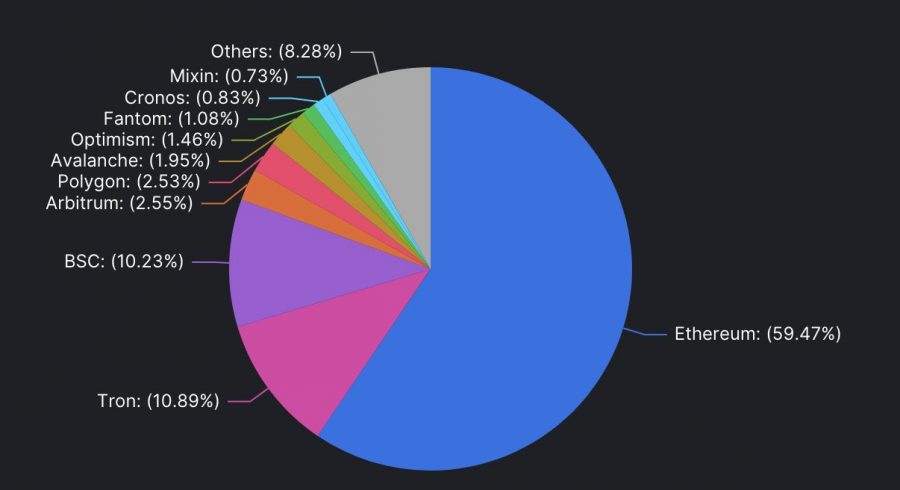

In early February 2023, Arbitrum has the highest total value locked (TVL) out of all Ethereum Layer 2 solutions. Arbitrum takes the slight edge on Polygon with a TVL of $1.25 billion (2.55% of industry TVL) compared to Polygon’s $1.23 billion TVL.

Supporting a higher TVL than Polygon is no small feat. Polygon is a top 10 crypto by market capitalization with a market cap of $10 billion. For comparison, the next largest Layer 2, Optimism has a market cap of $500 million.

Well-Developed Ecosystem

Arbitrum is already collaborating with a vast range of Ethereum dApps and infrastructure projects, including Uniswap, Sushi, DODO and dozens of others.

Will There Be an Arbitrum Airdrop?

As of January 2023, no official plans have been announced for an Arbitrum cryptocurrency airdrop. However, here are a few compelling reasons why an Arbitrum airdrop is likely.

Although Ethereum Layer 2 networks do not need a native token to operate, many other Layer 2 projects have launched their own tokens to facilitate governance and other use cases. A few notable examples include:

- Polygon

- Optimism

- Metis

- Loopring

On April 20, 2022, the same day that the Optimism airdrop was announced, Steven Goldfeder from Arbitrum tweeted the following message:

Another key reason why Arbitrum may launch a token airdrop is to reward its early adopters and repeat users. This strategy has been employed by several successful cryptocurrency projects, including Uniswap, a top 20 crypto by market capitalization.

Arbitrum AirDrop Guide

Unfortunately, there is no way to guarantee that you will be eligible for Arbitrum airdrop — if there even is one. However, several strategies can improve your chances of eligibility. These strategies focus on maximizing your activity, consistency and reach across the Arbitrum ecosystem.

1. Purchase Ethereum

The first step you need to take for your best chance at an airdrop is to acquire ETH — the native cryptocurrency of the Ethereum network. ETH is used to pay transaction fees on the Ethereum mainnet and Arbitrum.

Ethereum can be purchased through a centralized crypto exchange such as Coinbase, Uphold or KuCoin. After you have acquired ETH, you transfer it to your software wallet of choice.

Ensure that your chosen software wallet supports ETH or runs on the Ethereum mainnet. MetaMask — an Ethereum-compatible wallet that connects to hundreds of decentralized applications (dApps) — is a great choice.

Buy Ethereum

JOIN THE MOON OR BUST EMAIL LIST

Our team is diligently working to keep up with trends in the crypto markets. Keep up to date on the latest news and up-and-coming coins.

Disclosure: eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

2. Connect Arbitrum to MetaMask

To see ETH in your wallet, add the Arbitrum network to MetaMask (or your other chosen software wallet). This is an extremely easy step.

In the case of MetaMask, the easiest way to connect to Arbitrum is to use the one-click method. To do so, visit the Arbitrum Bridge website and click on Add/Switch to Arbitrum Network.

You will receive a pop-up message from MetaMask. Click on Approve, and the Arbitrum Network will be added to your MetaMask wallet.

3. Bridge Funds to Arbitrum

After you have purchased ETH, the next step is to bridge your ETH from the Ethereum mainnet to the Arbitrum network.

To bridge ETH, visit the Arbitrum website and connect your personal wallet to the application. From there, follow the instructions provided — the entire process can take several minutes to complete.

4. Complete Guild On-Chain Quests

Once your ETH has been bridged to the Arbitrum network, you will be able to complete a few tasks on Arbitrum that will grant you access to the Arbitrum guild.

Currently, there are no added benefits of joining the guild other than a corresponding role in Arbitrum’s official Discord; however, it is a great starting point for new users. To join the guild, visit the guild’s official website and complete the necessary tasks.

4. Weekly Arbitrum Interactions

Interact with Arbitrum frequently — either on a daily or weekly basis. This important step ensures that you are an active and consistent user.

The rationale is to use as many protocols that support Arbitrum as possible as frequently as possible. The developers have released no specifications for how much ETH (or other tokens) you need to move around. It is up to you to determine an appropriate amount of assets you want to keep on the Arbitrum network based on your unique risk tolerance.

Popular protocols that you can use that support Arbitrum and have interesting use cases include:

- GMX

- Hop Protocol

- Kyber Network

- 1inch

- Shell Protocol

Consider making swaps, taking trades and adding liquidity and staking within liquidity pools.

Where to Buy Ethereum

ETH can be traded on major exchanges such as HYCM, Binance (or Binance.US for U.S. investors), Uphold, Crypto.com and KuCoin. Many of these platforms allow you to purchase ETH using your credit card, through swapping features or via trading pairs such as ETH/USDT or ETH/BTC.

Get started

securely through HYCM’s

website

HYCM is 1 of the world’s leading forex brokers, offering investors access to over 69 unique currency pairs. However, forex isn’t the only thing the broker offers — HYCM also offers high rates of leverage, stock and ETF trading, commodity investing and much more. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes.

HYCM offers a varying fee structure, which allows investors to choose the spread option that’s best for them. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders. Though HYCM isn’t currently available in the United States, it can be a great choice for residents of the other 140 countries where it offers service.

Best For

- Investors who want a customizable fee schedule

- Traders comfortable using the MetaTrader platform

- Islamic traders who need swap-free accounts that don’t build interest

- Mobile app with a simple trading experience

- Wide range of currency pairs available

- Excellent selection of educational tools

- Not currently available to traders based in the U.S.

get started

securely through Binance’s

website

get started

securely through Uphold’s

website

get started

securely through crypto.com’s

website

Crypto.com strives to make cryptocurrency a part of everyday life by offering a full suite of services for crypto users. The company offers a Crypto.com App, Exchange, Visa Card, DeFi swap, DeFi Wallet, DeFi Earn, Crypto.com Price, staking, crypto lending, and many other services. What really sets them apart, however, is the combination of super low fees and incredibly generous rewards programs for their users.

Best For

- Traders who want access to a secure, low-cost cryptocurrency exchange

- Passive investors who want to earn interest on their balance without frequent trading

- Mobile investors who prefer to handle all their crypto needs via their phone or tablet

- Low fees

- High security

- One-stop shop for all your crypto needs (wallet, trading, spending, and more)

- Lots of ways to earn interest, rewards, and rebates

- Low privacy

- Customer service response time could be improved

Use Code rJYAWN7

securely through KuCoin’s

website

KuCoin is an exchange that appeals to traders and investors of all levels of experience and risk appetite. The platform has a simple interface that allows users to navigate through the various features of the platform on desktop, Android and iOS. KuCoin helps users gradually learn how to use the different instruments by offering beginner settings and gamified applications like Futures Brawl. Overall, it’s a strong platform for anyone looking to explore the variety of trading products that aren’t offered by other exchanges.

Best For

- Beginners and experienced traders

- Investors seeking a wide selection of tokens, including newer, smaller projects

- Investors experimenting with tools like trading bots, lending and futures trading

- Competitive trading and withdrawal fee structure

- Over 770+ trading pairs available

- No KYC required to begin trading but needed for credit or debit card use

- Engaging features like lending, customizable trading bots, futures and margin trading

- Ample security features like 2-factor authentication (2FA) and email notifications

- Because of the high level of functionality, new users may experience some difficulty interacting with certain features, but this can be avoided through proper research

How to Store Ethereum

Ethereum can be stored safely using a crypto wallet. Choose from two types of crypto wallets — software and hardware wallets. Software wallets allow users to easily manage their cryptocurrency, including buying, selling, swapping and lending through the internet. Hardware wallets, which keep private keys offline, are considered the most secure way to store ETH.

If you plan to actively engage in these tasks, it is recommended that you use a software wallet. Software wallets are superior at connecting to and interacting with decentralized applications (dApps) on the Arbitrum network.

Best Software Wallet: Trust Wallet

Trust Wallet is an industry-leading software wallet that enables crypto holders to store, buy, exchange and collect cryptocurrencies and NFTs all in one location. Acquired by Binance in 2018, Trust Wallet is trusted by millions of users worldwide. Users can access 250,000+ crypto assets on over 65 blockchains, which makes it a great choice for investors at all ends of the spectrum.

Is Preparing for the Arbitrum Airdrop Worth it?

While there is no guarantee that Arbitrum will have an airdrop or launch a utility token, strong evidence suggests that it is likely. To maximize your chances of eligibility, you may consider following a few of these tasks.

Whether or not an airdrop is announced, Arbitrum is still a great Layer 2 solution with a vibrant ecosystem of dApps. Being an active user doesn’t guarantee that you will be rewarded; however, the opportunity to leverage some of Arbitrum’s fascinating dApps and learn more about decentralized finance (DeFi) is a benefit.

The post Arbitrum Airdrop Guide by James Wells appeared first on Benzinga. Visit Benzinga to get more great content like this.