There are 4 different types of payment gateways based on hosting method, level of customization, and integration method:

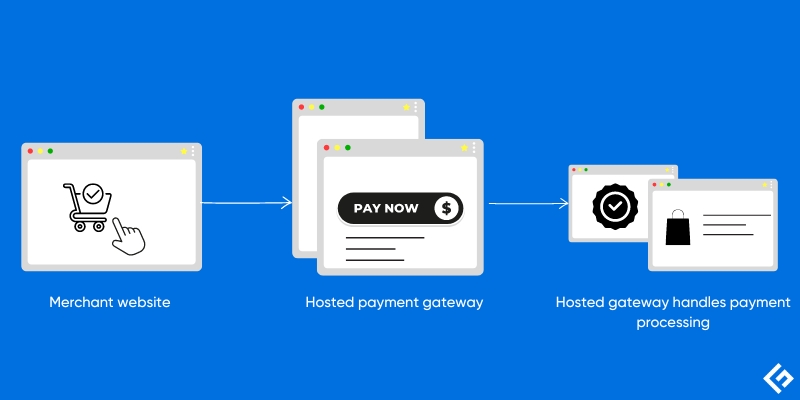

Hosted payment: This is the type in which a 3rd-party payment provider hosts the payment page. The flow of the requests is as follows: When customers check out to make payment, the request is directed to the secure site for entering information and completing the transaction before returning them to the merchant site.

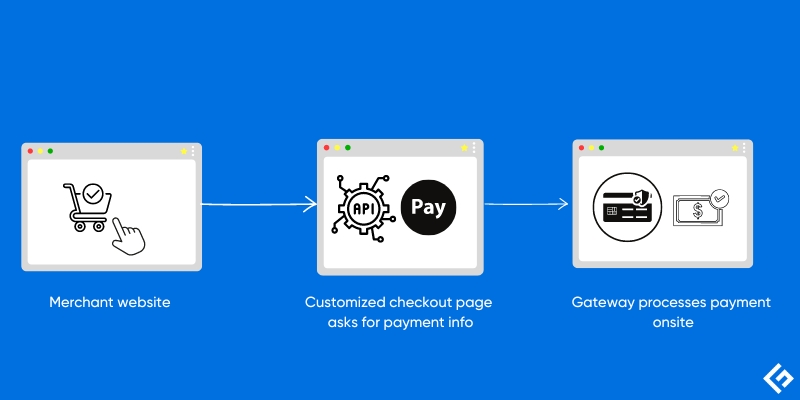

API-hosted payment: It is when the payment page is hosted on your website while it uses the Application Programming Interface (API) offered by a reliable gateway for the sake of transaction security.

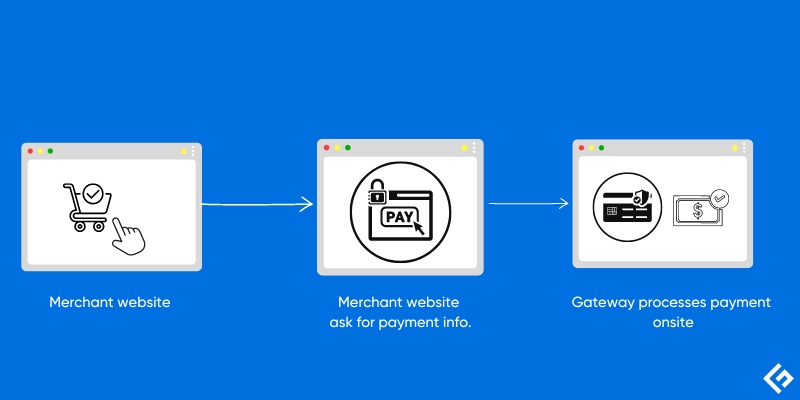

Self-hosted payment: This allows merchants a stronger level of control and the power to set up their transactional procedure completely on their servers, as it enables direct integration with a selected processor. However, this can get very complicated and needs quite a bit of technical resources, as well as in-depth know-how of PCI compliance.

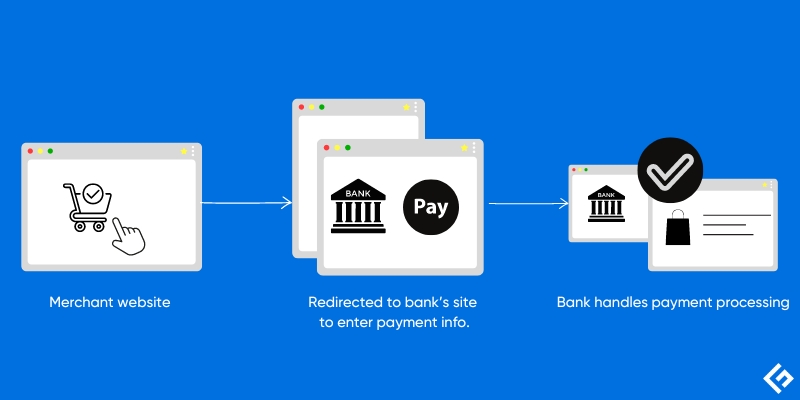

Local bank payment gateway: It is the local bank integration payment, where the payment gets directed towards the specific bank system through the application programming interface.

In the following section, we will examine different types of payment gateways and other aspects that will help you select the best payment gateway for your business.

Hosted Payment Gateway

A Hosted Payment Gateway is a secure and easy-to-plug third-party payment processing service into your website or app, handling the payment process from start to finish. When the customers click pay or checkout on your merchant site, they’re taken to the hosted payment gateway’s secure page. Here, they input their payment details, which get encrypted for the utmost security, following which they are sent for verification. On approval, the funds are transferred from the customer to the merchant.

A hosted payment service is the easiest of all the payment gateways to integrate but comes with limited customization and little or no branding.

A hosted payment gateway offers all that is required for secure transactions, such as PCI compliance, data encryption, and fraud prevention tools. Also, they offer zero maintenance for merchants and are easy to integrate with multiple payment options like credit cards, debit cards, e-wallets, etc.

Hosted payment gateways are mostly the preferred method by small businesses as they overcome development and other technicalities required to build custom payment gateways. Stripe, Square, and PayPal are the top companies offering hosted payment gateway services.

API-Hosted Payment (Offsite)

An API-hosted payment solution is a method of payment processing that allows integration of the Application Programming Interface (API) on merchant sites or business applications. One of the great benefits of utilizing an API-hosted payment solution is to customize the checkout page to provide a complete brand experience to customers.

For an API-hosted payment gateway, all relevant payment information is captured straight from your checkout page and transmitted to the gateway through a reliable API system belonging to a provider. The gateway carries out all the necessary verifications before a transaction can be said to be completed. On approval, the payments are transferred into your merchant account, and the customers get immediate confirmation on your website.

The whole process happens on your website, and customers need not have to leave the website; hence, it provides a smooth and branded experience for the customers.

A hosted payment gateway under the API requires businesses to take care of PCI compliance and data security measures, thus requiring a little more technical acumen for integration and maintenance than that required by hosted gateways. The payment methods are supported depending on the chosen API provider but usually include credit and debit cards, digital wallets, bank transfers, etc. Companies providing hosted payment gateways through APIs include Stripe, Braintree, Authorize.Net, Amazon Pay, etc.

Self-Hosted Payment (Onsite)

A self-hosted payment gateway allows businesses to process the complete transactions on their merchant site or app without directing customers to a third-party gateway.

The companies host self-payment gateways on-premise servers, on cloud servers, or on dedicated hosting platforms and support payment methods such as credit and debit cards, e-wallets, bank transfers, etc.

In most self-hosted payment gateways, there are various benefits such as customization of branding, easy-to-go processing, and low cost for those who have large e-commerce sites. Apart from this, there are some aspects such as security and compliance to look after by the businesses in a self-hosted scenario.

Additionally, one-time setup costs and recurring maintenance of the gateway infrastructure are also involved. They must ensure comprehensive security measures, including PCI compliance and data auditing, are in place. To achieve this, they should implement various security strategies such as fraud prevention tools, encryption, and detailed policies, all aimed at securing the transaction process effectively.

A merchant website or app making a transaction call will have their request directed to a self-hosted gateway. This gateway evaluates the request against predetermined policies for authentication and authorization purposes. The request is then routed to the appropriate back-end payment processor. The token is employed by the processor to make authorization checks with the bank. The outcome of the transaction, whether approved or denied, is communicated back to the customer on the merchant webpage.

Authorize.Net’s SIM and PayPal Payflow stand out in the competition for self-hosted alternatives as they permit flexibility, control, and security for those organizations that prefer to handle their own payment processing in-house.

Local Bank Integration Payment

A local bank integration payment gateway is a system that allows businesses to connect directly to local banks for the processing of online transactions from their merchant sites or apps.

A small business can accept payments from the customers of that specific region with a local bank integration payment option. A local bank integration is particularly useful for areas with stronger local bank connections. Though it may offer fewer features than the other payment gateways, it is much easier to set up, requires minimum technical integration, and offers lower processing fees.

Customers using supported banks in a region-specific manner would have an all-in-one buying experience. Transactions made through familiar banking environments might increase trust from customers toward your business.

Using Local Bank Integration as the payment method, customers are redirected to their bank’s online payment portal through secure protocols.

They use their bank login and authorize this transfer on their own. After authenticating, the bank transfers funds directly into your merchant account from the customer’s account.The customer is then directed back to the merchant website with a confirmation or decline message from their banking institution.

How to choose a Payment Gateway Provider?

If you are planning to get a payment gateway but not sure about what to look into, then the below points will surely help you to select the right one to meet your business needs:

Business model

Look into the business model of the company. If you are going to start a new business or you already have an existing business which is having low transactions, then you can prefer a hosted gateway that offers easy setup, low to and minimal maintenance, affordability, and frees up your time to look into your business growth.

Is your business scaling up with rising transactions? Think about an API-hosted gateway to potentially pay less per transaction and also for an increase in customer satisfaction.

If you are responsible for a large company with many transactions and personalization requirements, then a self-hosted payment gateway offers ultimate control and tailoring to your exact needs.

Global Presence

If the business is geographically dispersed, then you can prefer a Hosted payment or Self-hosted payment gateway based on your country and currency requirements. Moreover, note the quality and availability of their customer support and whether they will provide reliable assistance when needed. In case your business is only locally present, then you can even consider a local bank integration gateway that requires very minimum technicalities and also helps to increase customer trust with lower fees.

Cost

Consider all fees that will accompany the use of a payment gateway, not just the transaction cost. It will include setup and monthly fees, compliance costs, and additional chargebacks or international payments. A self-hosted gateway incurs high costs in setup and technical upkeep, while a hosted gateway seems cost-effective. But overall, select a provider who falls within the range of your budget, volume transactions, technical maintenance, etc.

A gateway with no setup fee may look less attractive at first sight, but in actual sense, it may cost more in the long run as your online sales increase.

Payment Methods

Ensuring your platform accepts all sorts of payment methods like credit/debit cards, digital wallets like PayPal or Apple Pay, bank transfers, crypto, mobile payments, etc., is one of the best ways to increase the sales of your business while reducing the bounce rate on your business website and app.

Before choosing a payment gateway, check whether your business runs on a recurring billing cycle or a subscription plan. While a hosted payment gateway and API-hosted payment support all kinds of payment methods, a self-hosted payment needs to be configured as per your business requirements.

Security and Compliance

Security and compliance are the top priorities every business, irrespective of size and type, should look into as it handles sensitive customer and financial data. Ensure your selected payment gateway adopts the industry’s best standards, such as Level-1 PCI DSS compliance, fraud prevention tools, and encryption of data while on the move and at rest.

A hosted gateway takes care of all security and compliances, while in the case of API hosted, only certain aspects are taken care of by the provider, and the rest need to be configured by the business. In a self-hosted gateway, it completely depends on the business type and level of security and compliance they need to implement.

Integration

Check out the technicalities involved in integrating the payment gateway into your merchant site and apps. For instance, some online businesses might need to integrate payment systems into CRM and update the bookkeeping, invoice, and other accounting details, so make sure the payment gateway allows integration into prominent e-commerce platforms like Shopify, WooCommerce, etc.

A hosted gateway comes with prebuilt integrations with shopping carts, CRMs, and accounting software. The API-hosted gateway allows integration with any software but requires the set-up to be implemented by some technical experts. If a business needs to manage all the required software or applications, then perhaps it is better to consider a hosted gateway, although, for this, both more infrastructure and technical competence are required.

Other factors

Some payment gateways imply transaction limits, so ensure this will not create a barrier for your business. Easy to set up, quick onboarding, and reporting analytics will help businesses to start accepting payments immediately. A hosted gateway supports quick onboarding compared to other gateways and even provides detailed reports.

What is the Best Payment Gateway for E-commerce?

Though the choice of the best payment gateway for e-commerce is totally based on the unique needs of the businesses, PayPal, Stripe, Amazon Pay, Google Wallet, and Shopify are some of the best payment gateways for E-commerce businesses due to the following:

PayPal is a well-known name internationally in the world of payment gateways. One of its most integral features is its user-friendliness, which enables the buyer and seller to secure any transaction.

Another top preference by developers, Stripe, comes in for its diversity when it comes to payment options and easy integration features. Many businesses choose it because of its advanced security features like the NIST Cybersecurity Framework and audited SOC reports.

Amazon Pay is unique from the pack because it provides not only easy integration but also distinctive loyalty programs catering to the specific needs of the Amazon community.

As one of the best-known players in this segment on a worldwide scale, Google Pay has effective anti-fraud technology, which is designed to satisfy businesspeople all over the world.

Shopify emerges as one of the best picks among Ecommerce businesses looking for diverse solutions under one roof, with respect to multi-omnichannel selling options coupled with the wide choice of payments, Shop Pay or Apple Pay.

What is the Best Payment Gateway for a Website?

Stripe, Authorize.net, PayPal, and Square remain the top players among payment gateways for websites for the following reasons:

The best high-volume payment gateway would be Stripe and Authorize.net, mainly because of competitive rates, security, and support in other countries.

The most user-friendly interfaces are offered by PayPal and Square payment gateways. These are best suited for low- to medium-traffic blogs or websites.

PayPal is one of the best methods of accepting payment for customers with no monthly fees, while Square is perfectly made for physical stores and mobile banking transactions, and it comes with Square’s easy-to-use point of sale (POS) system.

The best payment gateways for a website that targets a niche market will be mobile wallets like Apple Pay/Google Pay and Amazon Pay.

Which Payment Gateway is secure?

Payment gateways such as PayPal, Stripe, Braintree, Authorize.Net, Amazon Pay, Google Pay, Adyen, and Apple Pay do provide a secure payment gateway ensuring many security measures inclusive of PCI DSS Compliance, Transport Layer Security (TLS) Protocols, Tokenization, Encryption, 3D Secure, etc.

Is PayPal a Payment Gateway?

Yes, PayPal offers a payment gateway service called Payflow. Payflow payment gateway interlinks the merchant account to any major payment processor.

What is a Payment Gateway?

A payment gateway is a secure bridge connecting your online store, Ecommerce portal, or offline store to a POS system to consumer banks to ensure the transaction happens as per security standards.

A payment gateway encrypts sensitive customer data and transfers it to the payment processor. A payment processor sends this data to the customer’s bank for verification and confirms the outcome to the payment gateway, and finally, the payment gateway updates the transaction status on the merchant’s website or application.

A payment gateway is pivotal to the seamless and secure execution of financial transactions from consumers to merchants. It assures the security and reliability that consumers require in the constantly evolving e-commerce and traditional retailing marketplaces.

It ensures compliance with the laws whilst providing detection for fraud and offering timely confirmation or denial to customers on the merchant’s websites or apps.

Law Background and Legal Explanation:

Payment Gateways are bound by industry regulations and compliance with the rules of handling sensitive customer data. The Payment Card Industry Data Security Standard (PCI DSS) prescribes explicit security requirements for the storage, processing, or transmission of cardholder data. Also, Anti-Money Laundering (AML) regulations direct gateway providers to verify identification for fraud prevention.

In addition to that, data privacy laws in various parts of the world also dictate that the consent of the individuals has to be obtained before their personal data is to be used and collected through gateways.

Customers’ priorities have also changed in the ever-evolving digital transaction world. Speed was king; customers wanted fast checkout and quick transaction processing then and till now, with the prevailing trend in the last decade. Security issues were there, but they were remote compared to the present day and age. Cut to the present day, where security is king, mostly due to rising data breaches and scams, followed by convenience, transaction cost, and transparency back on the rise as users are now more aware across platforms.

How does Payment Gateway work?

Below is the step-by-step explanation of how the payment gateway works and ensures successful transactions, with examples from top players in each step:

Checkout: It refers to the final step a customer takes to purchase after adding items/products to the cart, entering payment information, and then clicking the pay button or checking out.

Stripe payment gateway provides a prebuilt checkout form that can be further customized to promote branding.

Payment Gateway: When a customer has filled up their shopping cart and is ready to check out, the payment gateway takes up the payment information, encrypts the sensitive financial data to avoid unauthorized access, and transfers it to the payment processor for final processing.

Authorize.Net has been in the industry for a while now. They are, therefore, reliable and provide strong security, such as Advanced Fraud Detection Suite, industry-leading encryption technology, and compliance support.

Payment Processors: The Payment Processors decrypt payment information from the payment gateway for authorization and forward it to the merchant’s financial institution. Payment processors are required to have a secure environment and, thus, are required to comply with certain standards of PCI DSS.

PayPal, Stripe, Amazon Pay, Google Pay, and Apple Pay are rated as the best payment processors by their global reach, compliance, and level of security.

Authorization: For authorization, the merchant bank forwards details to the customer’s bank, and based on the details, it will authorize or decline the information about the payment transaction.

Where Braintree is your payment gateway of choice, faster authorizations and quicker settlements may be realized.

Confirmation: At last, the payment gateway received the transaction status of approval or denial from the payment processor. This information will be presented to the customer on the merchant site and thus completes the transaction.

Stripe ensures that transaction updates are presented in real-time and in complete detail.

What are the Types of Online Payment Systems?

Here are some common types of online payment systems:

Traditional Methods

Credit cards: Most common and interest-based means, although they offer purchase protection and reward points.

Debit cards: Direct from your account, therefore easy to use, but they don’t offer any purchase protection.

Bank transfer: Safe and reliable, yet slow and manual to initiate.

E-wallets: Store card information for faster checkout and normally include other functionalities such as bill pay. (e.g., PayPal, Apple Pay, Google Pay)

Mobile Wallets: Near-field communication (NFC) for contactless payments.

Alternative Payment Method

Buy Now, Pay Later (BNPL): Divide the purchase into smaller installments. If not managed, it can get risky.

Cryptocurrency: A digital or virtual currency using cryptography for security, which is generally volatile. Since it’s not generally adopted by merchants, it’s less useful to spend.

Other options: ACH Transfers—This is a relatively slower form of bank-to-bank electronic transfers, but it is free of card fees.

Prepaid Cards: Loadable with funds for controlled spending, good for budgeting.

What are the Types of E-commerce Payments?

The following are the types of the E-commerce payments:

Credit and Debit cards: Credit and Debit cards are the popular ones in Ecommerce transactions. Under a credit card transaction, there will not be money worries in the bank account as the consumer will have a credit balance on the basis of the customer’s eligibility.

In the case of a debit card, the purchases are directly debited to the customer’s bank account, so if the bank account has a balance of a sufficient amount, then only that transaction will be allowed; otherwise, it will not. Both of these ways provide a very secure and convenient way of paying for your e-commerce payments.

Mobile wallets: Companies like PayPal, Apple Pay, and Google Pay are utilized as digital wallets to make e-commerce payments in a few taps. Mobile wallets are considered the most secure way of making online payments.

BNPL: Buy Now, Pay Later is adopted by people who wish to pay in installments. The companies like Klarna, Afterpay, PayPal, Zip, etc are in this business.

Bank transfer: The payment is done by means of direct bank account money transfer from the customer’s bank to the merchant’s bank. It is quite common in some countries.

Cash on delivery (COD): COD is a flexible system allowing a consumer to pay their merchant when the purchased good is delivered to their address. Most of the countries globally have COD existent.

What are the Best Credit Card Processing Companies?

Some of the leading companies in this sector are Stax, Square, PayPal, Stripe, and Helcim, which are the unique ones designed to excel in this market; although the best companies for processing credits depend on a lot of factors associated with businesses, as stated below:

Stax: Known mostly for lower cost of transactions in a high volume of transactions.

Square: Easily set up to deliver the funds quickly.

PayPal: Tops in this field due to its global availability in over 200 countries and the support of up to 70 currencies.

Stripe: Stripe embodies customization and subscription-based businesses.

Helcim: Helps in online transactions with inventory, customer profiles, and transparent pricing.

The major difference that these credit card processing companies have compared to common online payment systems or gateway systems are

Standards: One of the topmost compliances is with the security standards prescribed by PCI SSC – Payment Card Industry Security Standards Council, which will greatly prevent fraud associated with credit cards.

Charges: There are no such transaction and compliance fees if processed through regular online payment or gateway systems, but most credit card processing companies separate their transaction and compliance charges.

Advanced Features: Advanced features offered by a credit card processing company include fraud protection, chargeback management, and analytics of every single transaction.

Integrations: While normal online payment systems make online web or app transactions easy, full-stack credit card processing companies provide a wider solution for both hardware solutions for online and offline transactions.

The Credit card processing companies will need to adopt the regulations and standards that will ensure best practices, security, and compliance, such as:

PCI DSS and the PA-DSS: PCI Security Standards Council indicate these standards. The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards that describe the things credit card companies would like to see merchants do to protect customer data. PA-DSS standards ensure that all point-of-sale (POS) equipment and terminals meet the PCI DSS standards.

Card Issuer: Individual rules and regulations of the credit card processor governed by card issuers like Visa, Mastercard, and American Express. These solutions help govern transaction processing, prevent frauds and chargebacks, and ensure data security for safe and secure credit card payments efficiently.

Anti-Money Laundering (AML) Regulations: The law mandates that credit card processor service providers adhere to AML regulations framed to quell money laundering as well as funding terrorist activities.

Jurisdictional-based consumer protection regulations: There are legal data privacy laws like the GDPR within the EU or CCPA within the US that card processing companies adhere to. These policies state rules surrounding the collection, usage, and safety of personal consumer information, including credit card details.

Interchange Rates Regulation: Credit card processors are regulated due to interchange exchange rates.

What are the other Ecommerce Payment System Types?

The other E-commerce payment system types besides Payment gateway include:

Bank Transfers

Mobile payment solutions like QR code, NFC (Near Field Communication) payments

Digital Wallets (eWallets): PayPal, Apple Pay, and Google Pay

Cryptocurrency Payments: Some e-commerce platforms accept cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Mobile Wallets: Apple Pay, Google Pay, Samsung Pay etc.

Buy Now, Pay Later (BNPL) Services: Klarna, Affirm and Afterpay.

Alternative Payment Methods: Gift cards, loyalty programs, ACH transfers, etc.

In-store payment solutions like POS systems.

What is the difference between Payment Gateway and Payment Processors?

In online payment transactions, Payment Gateways and Processors work as a team to accomplish smooth and safe transactions end to end.

A Payment Gateway transmits encrypted payment information provided by the customer on the merchant site or app to the payment processor. Besides, the gateway interface also checks card authenticity and fraud behavior.

Payment processors receive encrypted data from gateways and work with customer banks to get transaction authorization. They are also responsible for fraud protection and chargebacks.

The whole process happens behind the scenes, but this actually ensures smooth and unobstructed financial exchanges with no security issues.

Task

Payment Gateway

Payment Processor

Function

Collects & transmits payment information from merchant site to payment processor.

Accepts payment data from the payment gateway, connects banks, processes transactions & transfers funds from the customer account to the merchant account.

Banking connection

Payment gateways don’t communicate with banks or card networks.

Connects to banks and other financial institutions to verify funds and perform transactions.

Activity

Encryption, checkout, and transfer of payment information from merchant site to payment processor.

Decryption verifies funds, authorizes the transactions, does necessary credit (merchant) and debit (customer), and sends confirmation.

Communication

It is the front-end interface. Communicate approvals or rejections of payments on the merchant site.

It manages the backend processing. Payment processors facilitate the transaction and communicate with payment gateways for transaction approval or decline.

Examples

Stripe, Braintree, Adyen, Authorize.Net

PayPal, Stripe, Amazon Pay, Google Pay, Apple Pay.